Fearing weak fundraising options in the wake of the WeWork implosion, late stage startups are tightening their belts. The latest is another Softbank-funded company, joining Zume Pizza (80% of staff laid off), Wag (80%+), Fair (40%), Getaround (25%), Rappi (6%), and Oyo (5%) that have all cut staff to slow their burn rate and reduce their funding needs. Freight forwarding startup Flexport that is laying off 3% of its global staff.

“We’re restructuring some parts of our organization to move faster and with greater clarity and purpose. With that came the difficult decision to part ways with around 50 employees” a Flexport spokesperson tells TechCrunch after we asked today if it had seen layoffs like its peers.

Flexport CEO Ryan Petersen

Flexport had raised a $1 billion Series D led by SoftBank at a $3.2 billion valuation a year ago, bringing it to $1.3 billion in funding. The company helps move shipping containers full of goods between manufacturers and retailers using digital tools unlike its old-school competitors.

“We underinvested in areas that help us serve clients efficiently, and we over-invested in scaling our existing process, when we actually needed to be agile and adaptable to best serve our clients, especially in a year of unprecedented volatility in global trade” the spokesperson explained.

Flexport still had a record year, working with 10,000 clients to finance and transport goods. The shipping industry is so huge that it’s still only the seventh largest freight forwarder on its top Trans-Pacific Eastbound leg. The massive headroom for growth plus its use of software to coordinate supply chains and optimize routing is what attracted SoftBank.

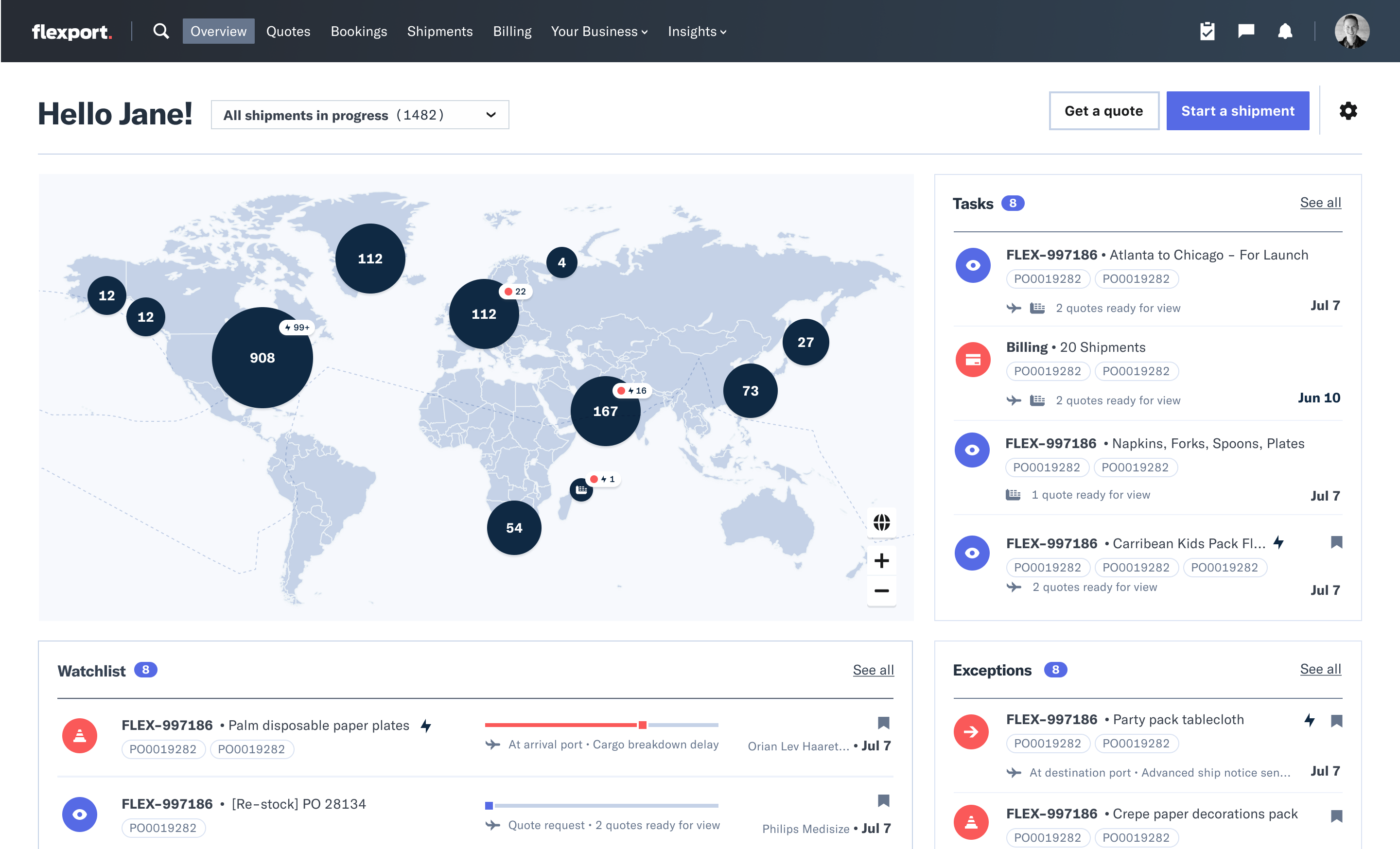

The Flexboard Platform dashboard offers maps, notifications, task lists, and chat for Flexport clients and their factory suppliers.

But many late-stage startups are worried about where they’ll get their next round after taking huge sums of cash from SoftBank at tall valuations. As of November, SoftBank had only managed to raise about $2 billion for its Vision Fund 2 despite plans for a total of $108 billion, Bloomberg reported. LPs were partially spooked by SoftBank’s reckless investment in WeWork. Further layoffs at its portfolio companies could further stoke concerns about entrusting it with more cash.

Unless growth stage startups can cobble together enough institutional investors to build big rounds, or other huge capital sources like sovereign wealth funds materialize for them, they might not be able to raise enough to keep rapidly burning. Those that can’t reach profitability or find an exit may face down-rounds that can come with onerous terms, trigger talent exodus death spirals, or just not provide enough money.

Flexport has managed to escape with just 3% layoffs for now. Being proactive about cuts to reach sustainability may be smarter than gambling that one’s business or the funding climate with suddenly improve. But while other SoftBank startups had to spend tons to edge out direct competitors or make up for weak on-demand service margins, Flexport at least has a tried and true business where incumbents have been asleep at the wheel.

from TechCrunch https://ift.tt/3baRKXR

No comments:

Post a Comment